The Buzz on Custom Private Equity Asset Managers

The 8-Minute Rule for Custom Private Equity Asset Managers

(PE): investing in firms that are not openly traded. Approximately $11 (https://giphy.com/channel/cpequityamtx). There may be a couple of things you don't understand regarding the sector.

Exclusive equity companies have a variety of financial investment choices.

Due to the fact that the most effective gravitate toward the bigger bargains, the center market is a considerably underserved market. There are extra sellers than there are very seasoned and well-positioned financing specialists with comprehensive buyer networks and sources to manage an offer. The returns of exclusive equity are usually seen after a few years.

More About Custom Private Equity Asset Managers

Traveling listed below the radar of huge multinational companies, numerous of these little business commonly provide higher-quality client service and/or particular click for source niche items and solutions that are not being supplied by the huge empires (https://businesslistingplus.com/profile/cpequityamtx/). Such upsides draw in the passion of private equity companies, as they have the understandings and wise to exploit such opportunities and take the firm to the next degree

Exclusive equity financiers have to have trusted, qualified, and reputable monitoring in position. Many managers at portfolio business are given equity and incentive compensation frameworks that reward them for striking their financial targets. Such alignment of goals is generally called for before an offer gets done. Exclusive equity opportunities are often unreachable for people who can not invest countless dollars, yet they shouldn't be.

There are guidelines, such as restrictions on the aggregate amount of money and on the number of non-accredited financiers (TX Trusted Private Equity Company).

Indicators on Custom Private Equity Asset Managers You Need To Know

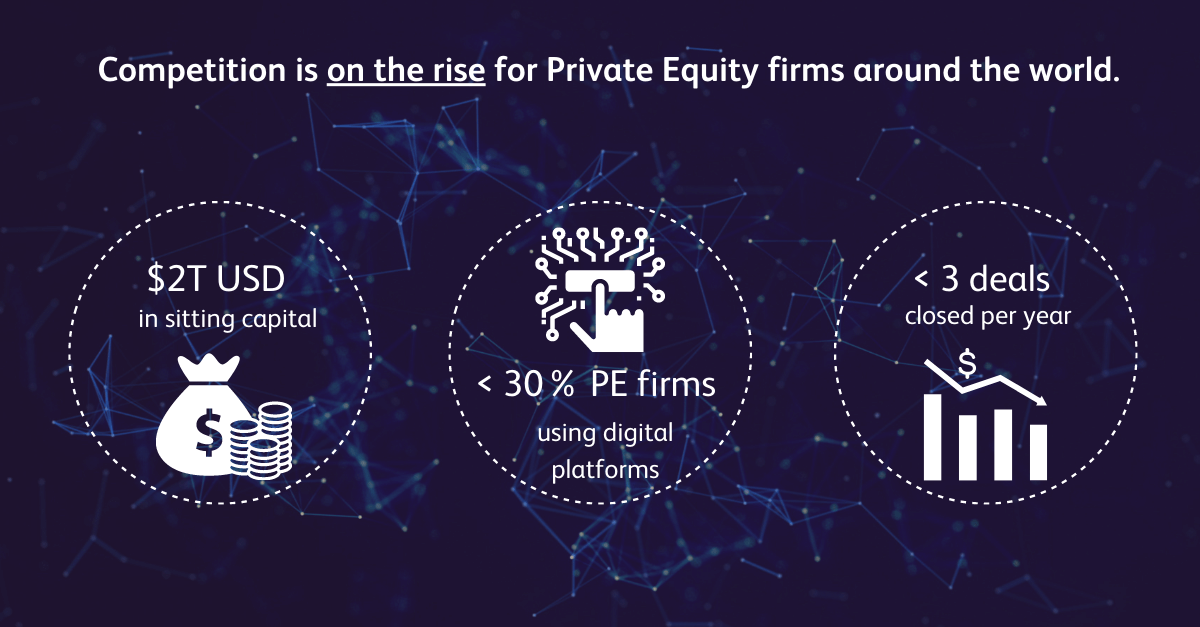

Another negative aspect is the lack of liquidity; as soon as in a personal equity deal, it is difficult to obtain out of or market. There is an absence of flexibility. Private equity also includes high charges. With funds under administration currently in the trillions, private equity companies have actually come to be eye-catching investment lorries for affluent individuals and establishments.

For decades, the features of personal equity have actually made the property class an eye-catching proposal for those who could take part. Now that accessibility to personal equity is opening as much as even more individual capitalists, the untapped potential is coming true. The question to take into consideration is: why should you invest? We'll start with the major disagreements for spending in exclusive equity: Just how and why private equity returns have traditionally been higher than various other properties on a number of degrees, How including exclusive equity in a portfolio impacts the risk-return account, by helping to expand against market and intermittent danger, Then, we will detail some crucial factors to consider and dangers for personal equity capitalists.

When it involves presenting a brand-new property right into a profile, one of the most standard factor to consider is the risk-return profile of that possession. Historically, exclusive equity has exhibited returns similar to that of Arising Market Equities and greater than all various other standard property classes. Its relatively low volatility combined with its high returns produces a compelling risk-return account.

What Does Custom Private Equity Asset Managers Do?

Exclusive equity fund quartiles have the best variety of returns throughout all different possession classes - as you can see below. Technique: Interior rate of return (IRR) spreads out calculated for funds within vintage years individually and after that averaged out. Average IRR was determined bytaking the standard of the mean IRR for funds within each vintage year.

The impact of adding private equity into a profile is - as always - reliant on the profile itself. A Pantheon study from 2015 recommended that consisting of exclusive equity in a portfolio of pure public equity can unlock 3.

On the other hand, the best exclusive equity firms have access to an also bigger swimming pool of unidentified possibilities that do not deal with the same scrutiny, along with the sources to execute due persistance on them and determine which deserve buying (Private Equity Firm in Texas). Investing at the very beginning implies greater threat, however for the firms that do prosper, the fund advantages from higher returns

The Definitive Guide to Custom Private Equity Asset Managers

Both public and private equity fund managers dedicate to investing a percentage of the fund but there stays a well-trodden problem with aligning passions for public equity fund management: the 'principal-agent issue'. When a capitalist (the 'primary') hires a public fund manager to take control of their capital (as an 'representative') they delegate control to the supervisor while maintaining ownership of the properties.

In the case of personal equity, the General Partner doesn't just earn an administration fee. They also make a percentage of the fund's earnings in the form of "carry" (generally 20%). This makes sure that the rate of interests of the manager are lined up with those of the capitalists. Private equity funds likewise minimize an additional form of principal-agent trouble.

A public equity investor ultimately wants one thing - for the monitoring to raise the supply rate and/or pay dividends. The financier has little to no control over the decision. We revealed above just how numerous personal equity methods - especially bulk buyouts - take control of the operating of the firm, making certain that the long-lasting value of the company comes first, rising the roi over the life of the fund.